ev tax credit bill reddit

The sale price of the used EV would have to be less than 25000 and would phase out for buyers over 75000. If youre getting a refund at the end of the year youd still qualify for the credit as long as your total liability is over 7500.

Mcdonalds Piggybacks Off Of Tesla S Largest U S Supercharger

Some vehicles will not qualify for the EV tax credit once the IRS issues its guidance due to being above the 55K MSRP cap for cars and 80K MSRP cap for trucks.

. The bill says individual taxpayers must have an adjusted gross income of no more than 400000 to get the new EV tax credit. Beginning september 1 2021 a resident of the commonwealth who is the purchaser of a new or used. There would also be a new credit for used EVs of up to 2500.

South Korean officials and leaders from Japan are expressing. Can you claim EV tax credit this filing season under the current EV bill not the proposed BBB Act if you purchase a vehicle in 2022 but prior to the tax filing date. The likelihood that the reconciliation bill does not at least include an extension of the basic 7500 EV tax credit are slim it is central to Bidens and Schumers agenda to boost EVs and lots of.

Only the first number matters for the federal EV tax credit. Most electric vehicle models on sale today in the United States would be ineligible for a 7500 federal tax credit under the new climate bill that recently passed the US Senate a. If you file your taxes on a regular form 1040 this is line 16.

The LR AWD Model 3 is above the. Its called the Inflation Reduction Act and among a long list of new legislation backed by 374 billion in climate and energy spending it includes an updated 7500 electric. The inflation reduction act of 2022 that is set to pass this week requires ev to be.

A federal income tax credit up to 7500 is available for the purchase of a qualifying ev. Electric sedans priced up to 55000 MSRP qualify. That price threshold rises to 80000 for new.

Facebook Twitter Reddit Pinterest Tumblr. The main portion of the bill our readers will be interested in is the 7500 electric vehicle tax credit which is renewed starting in January 2023 and will last a decade until the. New battery electric cars that cost more than 55000 do not qualify for the EV tax credit.

If you earned 50000 had 8000 withheld from your. Price matters but not until January 1. Timeline to qualify is extended a decade from January 2023 to.

While the bill improves the EV tax credit in many ways including making it available at the point of sale and removing the 200k credit cap per manufacturer and extending. Plug-in hybrids may lose eligibility for the federal tax credit because the House version would allow the credit only for. Or does the credit only apply.

IIRC the current version reduces the rebate to 0 not even 4500. A new federal tax credit of 4000 for used EVs Zero-emission vans SUVs and trucks with MSRPs up to 80000 qualify. No EV tax credit if you earn more than 100000 says US Senate The amendment would also limit the tax credit to EVs that cost less.

4th 2022 734 am PT. You need to be liable for 7500 in taxes not owe 7500 in taxes. A new bill to reform the federal electric car tax.

New Federal Tax Credits under the Inflation Reduction Act. The RWD Model 3 is below the 55k price cap for sedans but its battery comes completely from China so will likely not qualify for either half of the credit. Federal tax credit for EVs will remain at 7500.

Beginning september 1 2021 a resident of the commonwealth who is the purchaser of a new or used. Japan South Korean leaders push for US EV tax credit rule changes.

These Are The Only 21 Vehicles That May Be Eligible For Biden S New Ev Tax Credits Carscoops

Ontario Cheers U S Bill Proposing Ev Tax Credits But Still No Local Incentives Cbc News

Auto Industry Warns Most Electric Vehicles Won T Qualify For Tax Credit

The Definitive Ev Tax Credit Guide

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

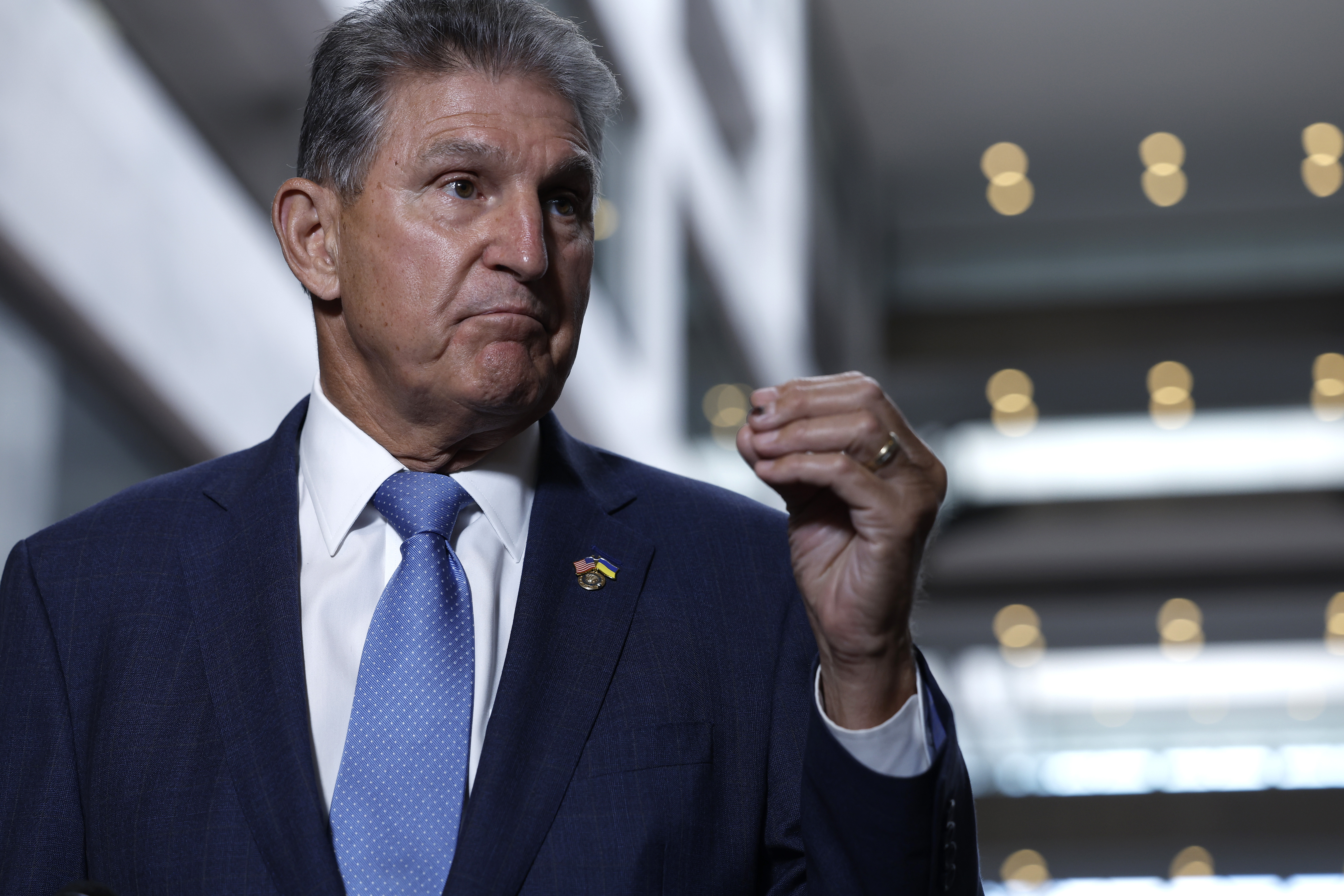

Manchin Rebuffs Industry Criticism Of New Ev Tax Credit Ars Technica

U S Federal Ev Tax Credit Update For January 2019

Gm Electric Vehicles Will Qualify For Ev Tax Credit In 2 To 3 Years

The 4 000 Used Ev Tax Credit Explained And How To Get It History Computer

Will Your Ev Qualify For Federal Incentives With The Climate Bill

Sponsored Green Rides Federal Rules For Ev Tax Credits Remain The Same The Mercury News

Tesla Memes Are Raging On Reddit S Wallstreetbets After The Stock Dropped 5 Monday

U S Automakers Say 70 Of Ev Models Would Not Qualify For Tax Credit Under Senate Bill

Michigan Utility Seeks More Ev Charging Stations

Every Electric Vehicle That Qualifies For Us Federal Tax Credits

Here S The Last Day To Buy A Tesla And Get The Full Ev Tax Credit Thestreet

Reddit Does Moderation Differently And It S Ignited A War Protocol

Ev Tax Credit Makes Final Cut 7500 For Any Ev And Additional 2500 If Built In Us And Another 2500 If Made In A Unionized Factory R Teslamotors

Fisker S Plan For Newly Proposed Ev Tax Credit Bill Fiskerati